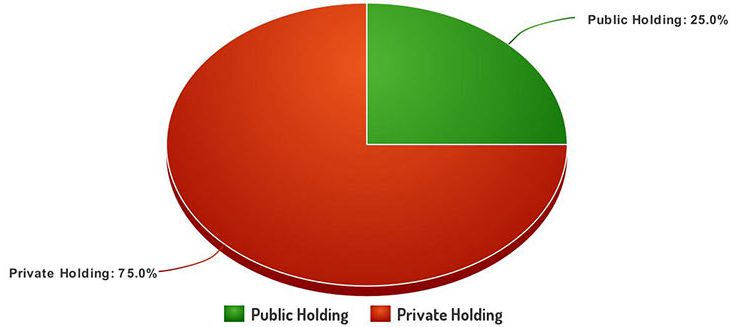

The Government has increased the bar of the threshold for a public shareholding in listed firms. The Securities Contracts Regulation Amendment Rules, 2010 have been notified today. As per the amendment, all listed firms will require to have a minimum 25% public holding.

SMC Capitals has tried to explain the impact of this news in their report.

The report says that the Finance Ministry has come out with the guiding principles necessitating the firms in order to maintain the public shareholding of at least 25%.

There are 183 Companies with public shareholding, which is no more than 25%. Therefore, in the case of these corporations, these guiding principles can activate a host of stake sales from these companies.

The total amount that is anticipated to get increased through these 183 FPOs is to the tune of almost Rs. 1, 50,527 Crore. The total amount that is anticipated to be increased by the PSUs is to the tune of about Rs. 1, 24,547 Crore, i. e. 83% of the total, and by the private sector is to the tune of about Rs. 25,981 Crore, i. e. 17% of the total, according to report.

Moneycontrol.com recommends users to check with specialized experts and get authentic information before taking any investment decisions.